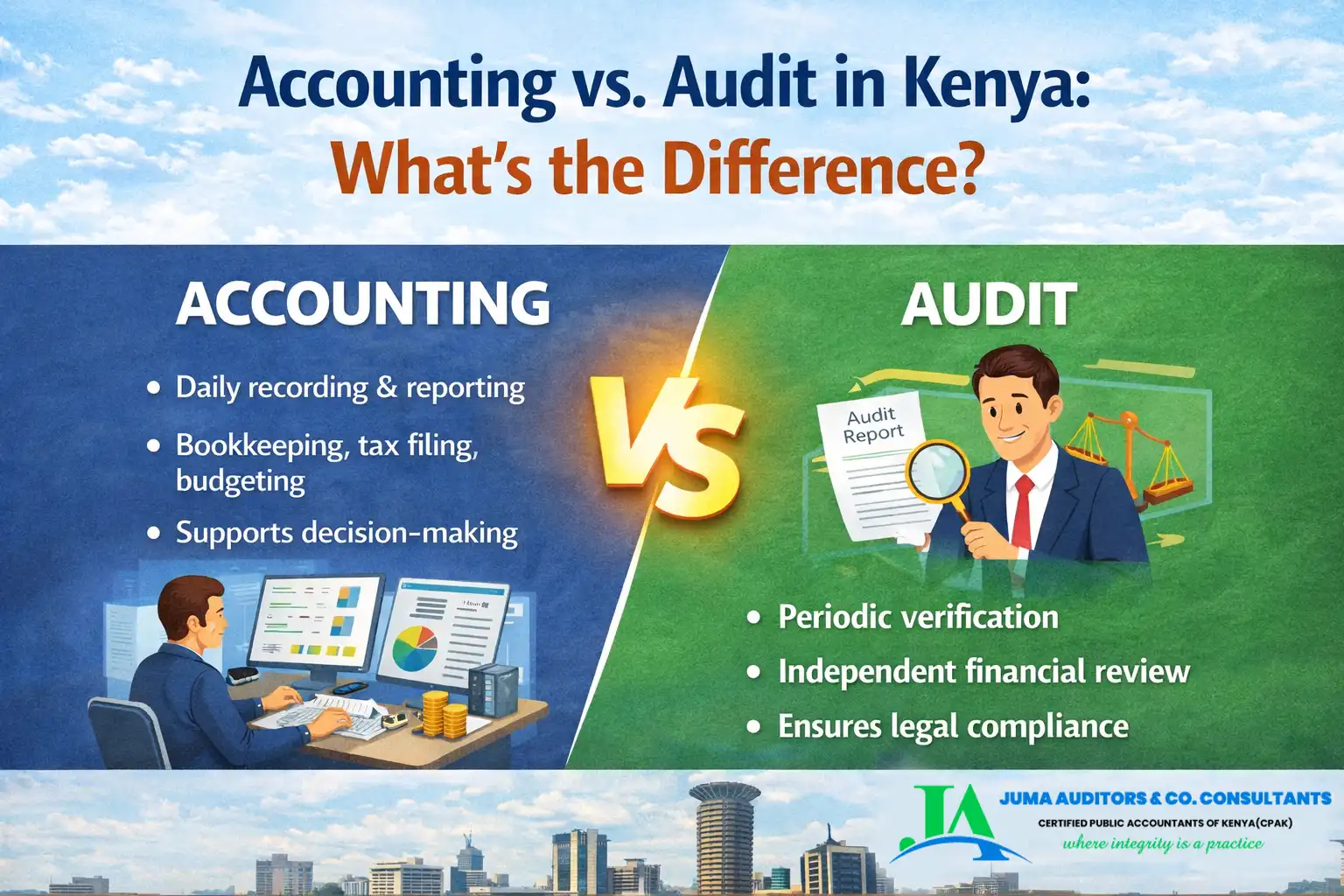

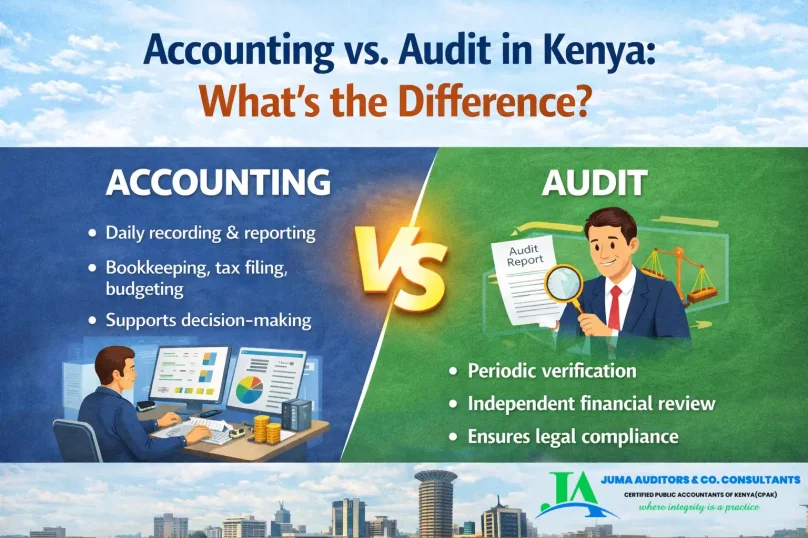

Accounting vs Audit in Kenya: What’s the Difference and Which One Does Your Business Need?

Running a successful business in Kenya involves much more than making sales and paying suppliers. Behind every sustainable and compliant business are accurate financial records that tell the real story of growth, profitability, and risk exposure.

Yet many business owners—especially SMEs and startups—often confuse accounting and audit. While closely related, these two services serve different purposes and are both essential at different stages of business growth.

As a trusted accounting firm in Nairobi and a professional audit firm in Kenya, Juma Auditors breaks down the key differences and helps you understand which service your business truly needs.

Understanding Accounting: The Foundation of Every Business

Accounting is the day-to-day financial management function of a business. It involves recording, analyzing, and reporting financial transactions to ensure business owners have a clear picture of their financial performance.

For businesses operating in Nairobi and across Kenya, proper accounting is essential for decision-making, compliance, and long-term growth.

Key Accounting Functions Every Business Needs

As a leading accounting firm in Nairobi, Juma Auditors provides the following core accounting services:

- Bookkeeping

Recording daily transactions such as sales, purchases, expenses, and payments. - Financial Reporting

Preparation of financial statements including income statements, balance sheets, and cash flow statements to assess business performance. - Tax Compliance and Preparation

Ensuring accurate filing of VAT, PAYE, income tax, and other statutory returns in compliance with KRA requirements. - Budgeting and Forecasting

Helping businesses plan for future growth, manage expenses, and avoid cash flow challenges.

Practical Example:

A Nairobi-based e-commerce business with proper accounting systems can track inventory, monitor profitability, file VAT returns accurately, and identify cost-saving opportunities. Without proper accounting, growth becomes guesswork and compliance risks increase.

Understanding Audit: Independent Verification and Compliance

An audit is an independent examination of financial records to confirm their accuracy, completeness, and compliance with Kenyan laws and accounting standards. Unlike accounting, which is continuous, audits are usually conducted annually.

As a registered audit firm in Kenya, Juma Auditors provides independent assurance that financial statements are reliable and credible.

Audits enhance transparency, credibility, and confidence in financial information, especially for third parties.

Common Types of Audits in Kenya

- Statutory Audit

Required by law under the Companies Act, 2015 for registered companies. - Tax Audit

Reviews tax filings to confirm accuracy and compliance with KRA regulations. - Internal Audit

Evaluates internal controls, risk management processes, and operational efficiency. - External Audit

Conducted by independent auditors to provide assurance to investors, lenders, and regulators.

Audited financial statements are often a key requirement when seeking financing, applying for tenders, or attracting investors. They provide assurance that the business’s financial information is reliable and trustworthy.

Key Differences Between Accounting and Audit

While closely related, accounting and audit serve distinct roles:

- Accounting focuses on recording and reporting financial data continuously.

- Audit focuses on verifying the accuracy and reliability of that data periodically.

- Accounting primarily serves business owners, management, and tax authorities.

- Audits are designed for investors, lenders, regulators, and external stakeholders.

In Kenya, all businesses benefit from proper accounting for financial management and compliance, while registered companies are legally required to undergo annual audits.

Which Service Does Your Business Really Need?

The reality is that most businesses need both accounting and audit services, depending on their size and legal status.

SMEs and Startups

- Require reliable accounting to manage finances, file taxes accurately, and support informed decision-making.

- Benefit from working with an experienced accounting firm in Nairobi.

Registered Companies

- Must undergo annual statutory audits to comply with the Companies Act, 2015.

- Audits also enhance credibility with banks, investors, and regulators.

- Benefit from working with a compliant and reputable audit firm in Kenya.

Even businesses not legally required to audit can benefit from voluntary audits, which help identify weaknesses, prevent fraud, improve internal controls, and unlock growth opportunities.

Why Choose Juma Auditors?

Juma Auditors is a trusted accounting firm in Nairobi and a professional audit firm in Kenya, supporting businesses across Nairobi, Mombasa, Kisumu, and other regions.

We offer:

- Accounting and bookkeeping services

- Tax advisory and compliance

- Statutory and external audits

- Internal audit and risk advisory

Our services are tailored for SMEs, startups, NGOs, and established companies, ensuring compliance, transparency, and sustainable growth.

Conclusion

Accounting and audit are not competing services—they are complementary pillars of strong financial management. Together, they help businesses remain compliant, attract funding, improve efficiency, and grow with confidence.

If you are looking for a reliable accounting firm in Nairobi or a compliant audit firm in Kenya, Juma Auditors is here to support you.

📞 Contact Juma Auditors today for professional accounting, audit, and tax solutions tailored to your business needs.